Cape Coral FL Property Management, Annual

Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape

Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral

Property Management Companies

SW Florida New Construction | Real Estate | Property Management | www.homeqwest.com

Saturday, January 31, 2015

Real Agents Don't Sleep!

Cape Coral FL Property Management, Annual

Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape

Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral

Property Management Companies

If you think it's expensive...

Cape Coral FL Property Management, Annual

Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape

Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral

Property Management Companies

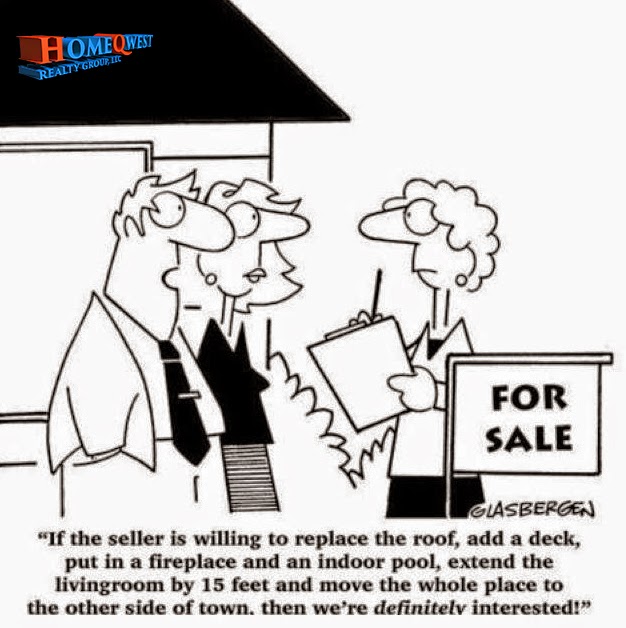

Buying A Home Common Contingencies To Purchase Offers

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

Eviction

http://homeqwest.com

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

How To Deal With A Bad Neighbor

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

How To Get Out of A Bad Commercial Lease

http://homeqwest.com

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

Know Your Rights On Background Checks

http://homeqwest.com

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

Landlord Duties

http://homeqwest.com

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

Rental Agreement Basics

http://homeqwest.com

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

Roommate Failed to Pay Rent

http://homeqwest.com

Cape Coral FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral Property Management Companies

Tenants Rights When Dealing With Roaches And Pests

http://homeqwest.com

Cape Coral

FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape

Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape

Coral Rentals, Cape Coral Property Management Companies

FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape

Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape

Coral Rentals, Cape Coral Property Management Companies

What Does Homeowners Insurance Cover

http://homeqwest.com

Cape Coral

FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape

Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape

Coral Rentals, Cape Coral Property Management Companies

FL Property Management, Annual Rentals Cape Coral FL, Long Term Rentals Cape

Coral FL, Homes for Rent Cape Coral Florida, Cape Coral Florida Rentals, Cape

Coral Rentals, Cape Coral Property Management Companies

What Is A Retaliatory Eviction

Cape Coral FL Property Management, Annual

Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape

Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral

Property Management Companies

What Repairs Does A Landlord Have To Make In A Rental Unit

Cape Coral FL Property Management, Annual

Rentals Cape Coral FL, Long Term Rentals Cape Coral FL, Homes for Rent Cape

Coral Florida, Cape Coral Florida Rentals, Cape Coral Rentals, Cape Coral

Property Management Companies

Friday, January 30, 2015

HomeQwest Realty Group, LLC: STORM ISSUES AND THE RESIDENTIAL TENANCY

HomeQwest Realty Group, LLC: STORM ISSUES AND THE RESIDENTIAL TENANCY: STORM ISSUES AND THE RESIDENTIAL TENANCY Reposted by HomeQwest Realty Group, LLC The numerous storms in Florida over the past few...

HomeQwest Realty Group, LLC

homeqwestrealty@gmail.com | O. 239.770.5429 | http://www.homeqwest.com

Cape Coral FL Property Management

Annual Rentals Cape Coral FL

Long Term Rentals Cape Coral FL

Homes for Rent Cape Coral Florida

Cape Coral Florida Rentals

Cape Coral Rentals

Cape Coral Property Management Companies

HomeQwest Realty Group, LLC

homeqwestrealty@gmail.com | O. 239.770.5429 | http://www.homeqwest.com

Cape Coral FL Property Management

Annual Rentals Cape Coral FL

Long Term Rentals Cape Coral FL

Homes for Rent Cape Coral Florida

Cape Coral Florida Rentals

Cape Coral Rentals

Cape Coral Property Management Companies

STORM ISSUES AND THE RESIDENTIAL TENANCY

Reposted by HomeQwest Realty Group, LLC

The numerous storms in Florida over the past few years have resulted in many new legal issues between the landlord and the tenant. Unfortunately most landlords were not prepared for the myriad number of problems, and often decisions were made which ended up in litigation. Common problems included the tenants taking it upon themselves to secure the property and in the process damaging the property. In many cases the premises were substantially damaged, and the tenant was allowed a rent rebate or some concession which ended up not satisfying the tenant and becoming a problem later. Construction workers often were not able to complete repairs in a timely manner. In severe damage situations, the tenants refused to vacate the premises and also refused to pay rent. Who is liable for protecting the tenant and his personal property? Can we make a tenant leave if the premises cannot be repaired quickly, or it is necessary to have the tenant leave the premises to have the repair properly made? What about generators? In a multi-family environment such as an apartment community, the misuse of a generator can put people and property at great peril. Can we prohibit them? The following discussion is preliminary at best and is meant to give you some ideas which you may wish to implement in your lease or an addendum to your lease. It is by no means complete, but it is a start.

The numerous storms in Florida over the past few years have resulted in many new legal issues between the landlord and the tenant. Unfortunately most landlords were not prepared for the myriad number of problems, and often decisions were made which ended up in litigation. Common problems included the tenants taking it upon themselves to secure the property and in the process damaging the property. In many cases the premises were substantially damaged, and the tenant was allowed a rent rebate or some concession which ended up not satisfying the tenant and becoming a problem later. Construction workers often were not able to complete repairs in a timely manner. In severe damage situations, the tenants refused to vacate the premises and also refused to pay rent. Who is liable for protecting the tenant and his personal property? Can we make a tenant leave if the premises cannot be repaired quickly, or it is necessary to have the tenant leave the premises to have the repair properly made? What about generators? In a multi-family environment such as an apartment community, the misuse of a generator can put people and property at great peril. Can we prohibit them? The following discussion is preliminary at best and is meant to give you some ideas which you may wish to implement in your lease or an addendum to your lease. It is by no means complete, but it is a start.

What are the Landlord’s obligations?

Many leases contain clauses reminding the tenant that the landlord is not responsible for their personal property, and the tenant agrees to this. Surprisingly, these clauses are not always upheld in court for situations in which damage to the tenant’s personal property was not due to any fault of the tenant. If there is a pipe break, and the tenant’s personal property is damaged or destroyed, this clause may not hold up. In the event of a storm, if there were some simple steps that the landlord could have taken to help preserve the personal property of the tenant from damage, things are not as clear. The duty of the landlord to secure the premises is not spelled out anywhere in Florida law. We recommend the following clause.

LANDLORD’S OBLIGATIONS: Tenant agrees Landlord has no obligation to install storm shutters and/or take measures to prevent wind, rain and/or other objects or projectiles from entering the premises in the course or event of a windstorm, flood, hurricane, hailstorm, tropical storm, or any other act of nature (hereinafter “Storm”) that may strike in the area of or affect the premises rented by Tenant from Landlord. Tenant agrees Landlord has no duty to advise Tenant as to evacuation orders, potential or current storms, safety measures, storm-preparedness procedures, or storm recovery resources. Tenant agrees to use due diligence in keeping informed of the current and future weather.

What about the tenant’s personal property?

Florida law does not prohibit or specifically allow a landlord to require a tenant to get insurance for her personal property, commonly known as “renter’s insurance”. There also is no affirmative duty on the landlord to secure the tenant’s personal property, which may be in accessible areas such as balconies or lanais. It is possible that a particular area of the outside of the premises is subject to flooding. The landlord may have a duty to warn tenants of this if the landlord has knowledge of a low section of the property or prior flooding. Many tenants are not aware that the typical insurance policy that a landlord has on a rental property in no way includes coverage on any of a tenant’s personal property or coverage for any other loss that may occur to a tenant other than personal injury or death due to the landlord’s negligence. We recommend the following clauses:

TENANT’S OBLIGATIONS REGARDING PERSONAL PROPERTY: Tenant agrees the rental premises are located in an area that may be subject to storms, and as a result, it is necessary to take steps to protect one’s personal property, including but not limited to securing objects that may become projectiles, keeping important documents in a location safe from damage, providing for the safekeeping of keepsakes, and obtaining appropriate insurance. Tenant understands that, even with precautions, damage to personal property, including vehicles, may occur.

RENTER’S INSURANCE: Tenant understands and agrees Landlord’s insurance if any DOES NOT cover injury or death to Tenant’s person or loss of any kind to Tenant’s personal property or expenses incurred by Tenant due to a storm, including but not limited to, loss of perishables, interruption of water, electric, cable or other utility service, relocation expenses and/or temporary or permanent housing. Tenant agrees he or she has an affirmative obligation to obtain renter’s insurance to cover losses in the event loss should occur to Tenant’s person and/or personal property due to a storm. Failure by Tenant to obtain renter’s insurance is done at the complete and total risk of the Tenant.

LIABILITY OF LANDLORD : Tenant waives any liability or duty on the part of the Landlord for any damage to person or property should any occur due to a storm. Tenant agrees to indemnify Landlord should any third party institute an action for damages against Landlord due to damages caused to person or property by Tenant’s personal property and/or Tenant’s actions or inactions relating to such personal property. Such indemnity shall include attorney’s fees and costs of Landlord incurred in any actions for damages by a third party.

Storm preparation actions by the tenant

Certain steps should be taken by a tenant to minimize the risk of harm to the tenant, personal property belonging to the tenant, and property belonging to others due to the tenant’s personal property becoming a projectile or otherwise causing damage to another’s property. At the same time, a landlord does not want a tenant to drill holes in the premises, put nails into the premises or take steps to protect the tenant’s personal property which could cause damage to the premises in the process. We recommend the following clauses:

STORM PREPARATION : Once a tropical storm, hurricane, flood watch or warning is issued for a particular area and/or at the request of Landlord, Tenant agrees to take storm preparedness actions. Any injury to Tenant arising from storm preparation is the sole responsibility of the Tenant and not of Landlord. In the event of damage to Landlord’s property due to Tenant’s storm preparations, that damage will be the responsibility of Tenant. Tenants shall remove all authorized and unauthorized objects from the immediate premises that may become projectiles in a storm, such as deck chairs, potted plants, patio benches and any items on a balcony, lanai, patios and/or breezeways of the rental premises. These items should be placed inside the apartment and returned to the outside only when it is safe to do so. In no event, shall any motorcycle, scooter, gas grill, or other item containing gasoline or other fuel, be stored inside in the rental premises. These items must be removed completely from the premises.

MODIFICATIONS TO THE PREMISES: Tenant agrees no modification shall be made to the premises including but not limited to attaching storm shutters, plywood or other items over doors or windows, taping duct tape or any other type of tape to windows or screens or making any other modifications or attaching any item to the premises. If Tenant fails to abide by this provision, Tenant shall be in breach of the lease agreement, shall be responsible for any damages to the premises and subject to eviction by Landlord.

Are storm shutters required?

In some areas, storm shutters are required for new construction, but most existing housing does not have any form of storm shutter system, be it removable or permanent. The tenant needs to understand that the landlord is not under an obligation to purchase storm shutters or to secure the windows and doors of the premises. Storm shutters can also give tenants a false sense of security, and the tenant needs to understand that storm shutters are simply one method to help minimize damage. If storm shutters are on the premises, the lease needs to address whose responsibility it is to engage these shutters, put them in place or remove them after a storm or a threat of a storm occurs. We recommend the following clause:

STORM SHUTTERS: If the premises are not equipped with storm shutters, Tenant understands that no storms shutters will be provided and/or no measures shall be taken by Landlord to secure doors and or windows unless Landlord, in its sole discretion, decides to perform these tasks. Tenant agrees to hold Landlord harmless for any damage to person and or property due to the lack of storm shutters or Landlord’s decisions to secure or not secure doors and/or windows. If storm shutters have been installed at the premises, or if Landlord secures door and/or windows, this shall not relieve the Tenant of the obligation of looking to his or her renter’s insurance for coverage of any damages to property or person. Tenant agrees that installation of storm shutters or other means of securing doors and windows are not guarantees in any way that damage to the premises due to a storm will be minimized or will not occur.

The generator problem

The landlord must decide if a gas powered generator will be allowed on the premises. Gas generator dangers are huge. Every year fires are started and individuals die of carbon monoxide poisoning due to generator misuse. In a single family home situation, the landlord may not have a problem with allowing the tenant to use a generator, but in multi-family housing the risks are multiplied greatly and are severe. Let us assume that an apartment community prohibits generators, but the tenant purchases and uses one on the premises. Can the landlord remove or disable the generator without liability? We are not sure, but we have created a clause which your attorney may want to review and give you his or her opinion. We are not by providing this clause stating that this clause will definitely be upheld in court or will not create liability on the landlord, so you have been warned.

GENERATORS AND FLAMMABLE LIQUIDS : Tenant agrees that NO GENERATOR(s) WHATSOEVER shall be permitted to be used by Tenant on, in or near the premises. Severe hazards are associated with storing and operating a generator at the property, including injury and death to persons and damage to property. Tenant agrees that NO FLAMMABLE LIQUIDS shall be permitted to be stored on, in or about the premises including but not limited to gasoline, kerosene or propane.

REMOVAL OF OR DISABLING OF GENERATORS BY LANDLORD: In the event Landlord is made aware that Tenant is in possession of or using a generator on, in or near the premises, Tenant by this document gives Landlord absolute permission to disable the generator and/or remove the generator from the premises without notice or further permission of the Tenant. Tenant agrees to hold Landlord, its agents, employees and assigns harmless for any damages suffered as a result of Landlord disabling and/or removing the generator from the premises. This includes damages to Tenant’s personal property due to lack of electricity and /or damages to or loss of the generator itself.

Notifications to the tenant

Nothing in Florida law requires a landlord to notify the tenant of an impending storm. It is good in multi-family housing though for the landlord to have a policy and procedure in place, as it only makes sense that the landlord take steps to notify tenants who may not be aware of the situation. A landlord cannot force a tenant to vacate the premises. We recommend the following clauses:

EVACUATION OF PREMISES: In the event a governmental entity orders an evacuation of the area, Tenant agrees to follow such evacuation orders. In the event Tenant fails to follow the evacuation orders, Tenant agrees that Landlord shall not be liable in any way for injury or death of Tenant or damage or destruction of Tenant’s personal property, including vehicles.

The damaged property Catch-22

The most common problem our office deals with in the aftermath of a storm is the damaged unit. The destroyed unit is easy. The tenants are gone and can’t move back in. The damaged unit creates serious issues. Does the landlord have to repair? Can the landlord timely repair? Is there water damage causing mold? Can repairs be made with the tenant present? Does the tenant have to pay rent? When a unit is damaged, we like the landlord to have the pure absolute option to terminate the tenancy and evict the tenant if necessary. We don’t need any arguments about the rent, reductions in rent, rent withholding, interference with repairs or any other problems from the tenant. We want the landlord to simply say “Get Out”, serve the tenant proper notice and file an eviction if the tenant fails to vacate. Proper lease wording is crucial. We recommend the following clause.

DAMAGE OR DESTRUCTION OF PREMISES: In the event the premises are damaged or destroyed by a storm, and in Landlord’s sole judgment it is necessary for Tenant to vacate the premises due to a dangerous condition on the premises or for repair, reconstruction or demolition, Tenant agrees that Landlord may terminate the tenancy. Tenant shall vacate the premises within the time period as designated by Landlord, and Tenant shall not be liable for any further rent under the terms of the lease agreement.

Contact with your attorney

Probably the most important thing you can do after a storm is to contact your attorney before releasing a tenant, giving a rent concession or making any deals or arrangements whatsoever with the tenant. Emotions are running high, situations often are emergent in nature, and anything you do with the tenant can have long lasting legal consequences. We urge you to examine your storm policies and procedures and have all preparations in place not just with the properties that you own or manage, but also your personal business. Many of our clients completely lost their offices in the past 3 years and were not prepared to be up and running again quickly. While this article dealt with your agreement with the tenant, you need to have a full meeting of the minds in writing with the owners of homes if you are a manager of single family homes, duplexes and the like. This topic will be examined more in depth in a future newsletter.

by Harry Anthony Heist, Attorney at Law

HomeQwest Realty Group, LLC

homeqwestrealty@gmail.com | O. 239.770.5429 | http://www.homeqwest.com

Cape Coral FL Property Management

Annual Rentals Cape Coral FL

Long Term Rentals Cape Coral FL

Homes for Rent Cape Coral Florida

Cape Coral Florida Rentals

Cape Coral Rentals

Cape Coral Property Management Companies

Wednesday, January 28, 2015

HomeQwest Realty Group, LLC: What Property Managers Need to Know About Form 109...

HomeQwest Realty Group, LLC: What Property Managers Need to Know About Form 109...: What Property Managers Need to Know About Form 1099 Reposted by HomeQwest Realty Group, LLC For property management companies , the mont...

What Property Managers Need to Know About Form 1099

What Property Managers Need to Know About Form 1099

Reposted by HomeQwest Realty Group, LLC

For property management companies, the month of January signals a time to prepare and issue year-end statements to their clients for tax preparation purposes. Consequently, each January the IRS requires that any taxpayers who have made payments in excess of $600 for services to vendors or workers that are not considered employees must prepare Form 1099 – Miscellaneous Income.

Property management companies are also federally required to file Form 1099 for their clients who have received in excess of $600 in rental income throughout the year. In addition, copies of this completed form must be provided to the IRS. The IRS compares the payments shown on the information returns with each recipient’s income tax return to determine whether the payments were reported as income and done so properly.

- The filing deadline for Form 1099 if filing by paper is February 28, 2014 (or March 31, 2014 if filing electronically).

- The IRS also requires that you file Form 1096 to identify all of the Form 1099s. (The filing deadline for Form 1096 is June 2, 2014.) Note: You don’t need to use the 1096 if you file electronically.

(Please consult your tax advisor. This information is provided courtesy of the IRS 2013 General Instructions page and is not intended to be considered tax or legal advice.)

Failure to issue a Form 1099 and file Form 1096 results in penalties and potential disallowances of deductions for those amounts paid. Thus it is imperative to comply with these filing requirements.

Embrace technology and don’t let 1099s and bulky year-end report packages get you down. Use January to focus on the upcoming year and not the past.

HomeQwest Realty Group, LLC | homeqwestrealty@gmail.com | O. 239.770.5429 | http://homeqwest.com

Cape Coral FL Property Management

Annual Rentals Cape Coral FL

Long Term Rentals Cape Coral FL

Homes for Rent Cape Coral Florida

Cape Coral Florida Rentals

Cape Coral Rentals

Cape Coral Property Management Companies

HomeQwest Realty Group, LLC: When You Don’t Accept Section 8

HomeQwest Realty Group, LLC: When You Don’t Accept Section 8: When You Don’t Accept Section 8 Reposted by HomeQwest Realty Group, LLC “WE DON’T TAKE SECTION 8.” Have you ever said this to a prospe...

When You Don’t Accept Section 8

Reposted by HomeQwest Realty Group, LLC

“WE DON’T TAKE SECTION 8.” Have you ever said this to a prospective renter in your office? A simple factual statement like this could lead to a discrimination complaint being filed against your company and maybe even you personally.

Picture this scenario. It is rainy season, you have been stuck in traffic all morning, and in the 20-foot walk from your car to the office, you get completely drenched by rain, not to mention having to walk through a 4 inch stream of water running through the parking lot in your new sneakers. The day is to getting off to a bad start. You are not even settled in your office when the receptionist tells you that some people are in the lobby wanting to speak with you about a rental they saw. You come to the lobby, where a small child has just tipped over a chair and is proceeding to empty the water cooler on the floor. The mother is screaming at the child, the father is grabbing the child, and they appear to be from another country based on their ethnic dress. Between the screams from the child, the father asks you about a house they drove by that had a “for rent” sign on it from your office. You begin to answer some of their questions about the home, trying hard to hide your annoyance with the situation, and Section 8 comes up. This is when you blurt out the statement, “We don’t take Section 8”. When asked why, you simply say, “We don’t take it. It’s company policy; sorry”. Puzzled and angry, the prospective renters leave your office. No Section 8? Why not? These people have been renting for the last 5 years with their Section 8 vouchers. This is the very first time they have ever even heard someone say that Section 8 was not accepted. They leave the office bewildered and shocked. Since they have experienced discrimination before, they assume that you simply do not want to rent to them based on where you think they are from. Plausible? Sure. Many people of protected classes experience blatant discrimination each day, and this just appears to them to be one of those instances. A discrimination complaint with HUD is filed online using the HUD provided handy app on their smartphone, and next thing you know, you are hiring an attorney at $450 an hour to fight a baseless accusation of discrimination. Did you illegally discriminate? We know you did not, but that is not the point.

Are you required to take Section 8?

For the most part, unless there is a special source of income ordinance in your city or county, you are not required to take Section 8 or be any part of the Section 8 program. Your company may have decided that it simply does not want to be involved with a federal program such as Section 8 because of the rules, regulations, inspections and other requirements of the program. This is perfectly okay and legal. Unlike some states, as of this writing, only one municipality in Florida has a source of income ordinance, which means that you must accept Section 8 in that municipality if the applicant otherwise meets your approval process criteria. When source of income “discrimination” is made illegal, the Section 8 funds must be counted as part of income. The problem in the above example is that it just does not look good how you handled the inquiry.

How to handle the inquiry

The delivery of the statement is the key here: how you say it. Instead of blurting out the fact that you do not take Section 8, you should take the time to explain nicely that your company is not connected or set up with the Section 8 program. Tell the person inquiring that your company has decided it does not want to get involved with the program due to the requirements. Maybe your company does not want to deal with the red tape and bureaucracy. Explain to anyone inquiring that not all property management companies or apartment communities take Section 8, and that is it not required by law. Be nice. Be clear. Be patient. Take your time.

Referring the Prospect

After you are finished explaining that you are not part of the Section 8 program and why, the best part comes. You simply hand the prospect a list of a names and numbers of local management companies and/or apartment communities that you know for a fact accept Section 8. Take your time to shop around your competition, and call your fellow housing providers. Many will gladly take referrals, and possibly you can legally be paid a referral fee as well. Create a diverse list. Do not rush into this. Simply recommending a low income housing apartment community down the street is certainly to be avoided. Many companies accept Section 8, but you would not even know it. A good updated list you can hand out to a prospect is priceless. Now… Do you take Section 8?

by Harry Heist, Attorney at Law

HomeQwest

Realty Group, LLC

homeqwestrealty@gmail.com | O.

239.770.5429 | www.homeqwest.com

Cape Coral

FL Property Management

Annual

Rentals Cape Coral FL

Long Term

Rentals Cape Coral FL

Homes for

Rent Cape Coral Florida

Cape Coral

Florida Rentals

Cape Coral

Rentals

Cape Coral

Property Management Companies

Tuesday, January 27, 2015

HomeQwest Realty Group, LLC: Penalizing a Resident for Lack of Notice

HomeQwest Realty Group, LLC: Penalizing a Resident for Lack of Notice: Penalizing a Resident for Lack of Notice by Harry Heist, Attorney at Law Your resident left at the end of the lease and did not give...

Penalizing a Resident for Lack of Notice

by Harry Heist, Attorney at Law

Your resident left at the end of the lease and did not give any notice. What can you charge? Your lease requires 60 days’ notice, and the resident gave notice that was 20 days too short. What do you charge? These two questions have caused more confusion than almost anything else in dealing with the departing resident. The vast majority of property managers will answer these questions incorrectly, charge the resident the wrong amount and will expose the owner and/or management company to litigation. We have written 2 articles on this already over the years, but it is time to revisit the subject, as it is getting bad out there, real bad.

If you think you know what you are doing when it comes to charging the resident, there is a really high chance you are wrong. The reason you are probably wrong is that the law goes against logic and intuition. It would seem perfectly logical and fair to charge a penalty for failure to give notice or to charge the resident the full 60 days’ notice worth of rent if they only gave 45 days’ notice, but it just is not the case as far as the law goes.

Before we move on with this article, try to cleanse your mind of how you may have been charging the resident in the past. Let us start from scratch here, and look at this with an open mind, realizing that just because you got away with doing something for so many years, or it is your “company policy” or procedure, it probably is wrong.

The whole business about charging a resident for improper notice coinciding with the lease expiration date is governed by law. It is all addressed in Florida Statute 83.575. Rather than look at the law now, we will break it down first in a practical way, and see how we can successfully charge for improper notice or no notice at all. Try to think about the fact that a typical lease has a beginning date and an ending date. It is very simple. The resident moves in on the beginning date and is supposed to move out at as of the ending date. However, the issue is that the property manager wants to know if the resident indeed plans on moving out, or conversely, if the resident plans on staying. This makes sense of course. If you know the resident is moving out, you will begin to market the unit and hopefully get someone to take the resident’s place as soon as possible. If you are kept in the dark about the resident’s future plans, this inconveniences you and may result in you losing money. You are not able to properly plan and market the unit when you have no idea what the resident will do, and you assume, sometimes incorrectly, that the resident will simply stay or renew. What do you do to that resident who does not give you any notice or gives you short notice? Well, you want to punish that resident, and you hope that the threat of this monetary punishment will result in proper notice being provided. So far so good, and we all agree.

Now comes the law. The law changed a number of years ago after a major lawsuit put a big damper on charging any sort of penalty to a resident. The “new” law allowed a penalty, BUT special procedures had to be adhered to carefully. You MUST know them, and they are tricky.

Prior to the law changes, it was a free-for-all regarding charges to a resident in the event of improper notice. Property managers would simply charge the resident whatever the lease agreement allowed, or the property manager would see how many days were required, and if the resident gave a short notice, the resident would be charged until the end of the notice period. Some judges and legislators just did not like this. Residents would often forget to give the notice required by the lease, and then they would be hit with a big penalty or be required to pay rent for days past the day they vacated. The result was a change to the law. NOW, the property manager MUST do something special in order to enforce the notice requirement of the lease. It is not hard.

REMINDING AND INFORMING THE RESIDENT

The laws now states that the property manager must “REMIND” the resident of when the lease expires, inform the resident exactly what the notice requirement of the lease is, AND DETAIL the penalty that the resident will be hit with if the resident does not give the proper notice. Keep this in mind for the rest of this article: “REMINDING” AND “DETAILING”. The purpose of the law and the procedure set out is to make sure that a resident is not charged a burdensome penalty for something that the resident “FORGOT” to do. It is more about being fair to the resident who may forget to follow the lease and forget to give you notice.

WHEN MUST YOU “REMIND” THE RESIDENT?

You cannot remind the resident too far out in advance, because the resident may forget. You have to remind the resident in the “reminder window”. The “reminder window” is the period of 15 days BEFORE the notice period begins. Read this a couple more times!

Let’s look at some examples:

Scenario #1: The lease requires the resident give 60 days’ notice prior to the end of the lease. The property manager does nothing, the resident does not give any notice, and she leaves at the end of the lease.

Result: The property manager CANNOT charge the resident for failure to give notice. Why? Because the property manager did not REMIND the resident in the proper “reminder window”. In fact, the property manager did not tell the resident anything at all. It does not make a bit of difference what your lease provides.

Scenario #2: The lease requires the resident give 30 days’ notice prior to the end of the lease. The property manager sends out a Renewal Offer Letter two full months before the end of the lease. The renewal offer tells the resident when the lease expires, how much notice must be provided if the resident is not planning to renew, and the penalty for failure to give notice. The resident does not respond with any notice and leaves at the end of the lease.

RESULT: The property manager CANNOT charge the resident for failure to give notice BECAUSE the property manager reminded the resident TOO FAR IN ADVANCE.

Scenario # 3: The lease requires the resident gives 60 days’ notice prior to the end of the lease. The property manager sends a Renewal Offer Letter detailing the terms of renewal, the notice requirement and detailing the penalty for failure to give notice. The property manager sends this out 50 days before the end of the lease. The resident leaves at the end of the lease, giving only 10 days’ notice.

RESULT: The property manager CANNOT charge the resident the insufficient notice penalty of the lease, because the property manager did not send the Renewal Offer Letter out in the proper “REMINDER WINDOW” period.

Scenario #4: The lease requires the resident gives 60 days’ notice prior to the end of the lease. The property manager sends a Renewal Offer letter 70 days before the end of the lease offering a renewal, confirming when the lease is set to expire, detailing what notice is required under the lease and reminding the resident what penalty exists under the lease for not providing proper notice. The resident leaves at the end of the lease, only giving 30 days’ notice.

RESULT: The property manager CAN charge the resident the insufficient notice fee of the lease, because the property manager gave the resident “PROPER NOTICE WITHIN THE “REMINDER WINDOW”” period.

What is the “REMINDER WINDOW” PERIOD?

It is the period “WITHIN 15 DAYS BEFORE THE BEGINNING OF THE NOTICE PERIOD REQUIRED OF THE RESIDENT”.

This means that besides containing terms of the renewal offer, confirming when the lease expires, detailing the lease provision of what notice is required of the resident, AND the lease penalties for failure to give notice, this correspondence is delivered within a special 15 day window. Focus on that “window”.

A PROPER “RENEWAL OFFER LETTER”

The “RENEWAL OFFER LETTER” should contain the following to cover all bases:

1. The terms of renewal you are offering the resident. For example, the rent amount. 2. A deadline for the resident to accept the offer of a renewal and sign a renewal lease. 3. When the lease expires. 4. The AMOUNT OF DAYS’ NOTICE REQUIRED BY THE RESIDENT UNDER THE EXISTING LEASE IF THE RESIDENT DOES NOT WANT TO RENEW. This can be up to 60 days. 5. The PENALTY AMOUNT UNDER THE EXISTING LEASE if the resident fails to give you proper notice of an intention to vacate.

Note that we recommend that the penalty for improper notice not exceed one month’s rent. The MAXIMUM amount of notice you can require of the resident is 60 DAYS.

CHARGING THE RESIDENT FOR SHORT NOTICE

Suppose the resident is supposed to give you 60 days’ notice according to the terms of the lease, BUT the resident only gives you 15 days’ notice and leaves on the last day of the lease. You never bothered to send them any kind of reminder notice, or maybe your Offer to Renew Letter that you sent out did not properly list the penalties for not giving enough notice. Can you charge the resident for 45 more days rent? NO!!! But why not? The resident’s notice was short! Well, you just cannot do it. The ONLY time you can charge the resident a “penalty” is if you follow the statute.

Conclusion

Confused yet? Many people are. You need to understand this law and the procedures extremely well, or your company can get in a lot of trouble. When you charge a resident improperly, this amount often ends up on a credit report, and if a lawsuit is filed against you years from now, the mistake will come back to haunt you. The key is to understand fully that if a resident does NOT give you notice or gives you short notice, you cannot automatically charge the penalty contained within the lease. You must go back and see if you followed the law. The key is to have a system in place to make 100% sure that your Offer to Renew Letter is delivered in the 15 day “reminder window”, and the offer to renew has the proper wording in the body of the document.

HomeQwest Realty Group, LLC – SW Florida Homes and Houses for sale. Cape Coral Fl Homes and houses for rent or lease, SW Florida Land for sale, acreage and general Property Management and Real Estate Information

534 SE 16th Pl, Cape Coral, FL 33990 | homeqwestrealty@gmail.com | O. 239.770.5429 | http://homeqwest.com

Annual Rentals Cape Coral FL

Long Term Rentals Cape Coral FL

Homes for Rent Cape Coral Florida

Cape Coral Florida Rentals

Cape Coral Rentals

Cape Coral Property Management Companies

Friday, January 23, 2015

Embezzlement In Property Management. Can It Happen?

Embezzlement In Property Management. Can It Happen?

Unfortunately, it happens. Security funds, landlord reserves, rental disbursements that sit idle and rents paid in cash is as tempting to take as it gets. Property management is rife with opportunities to steal. This is true in both residential and commercial markets.

How are you as a tenant or landlord protected? There are state regulators and laws in place to minimize this practice, but once the money is gone it's gone.

Red flags to look for

Consistently late rental disbursements. Vendors that aren't paid or are paid after a 90 day time-frame. Stall tactics when paying bills. No replies to accounting questions when you call or email. Employees that dodge accounting questions. Phony vendor invoices for work that wasn't really done. Asking to speak with the contractor that did the work only to hear, we cant do that, that's confidential information. Getting bulk invoice costs. All estimate items need to be laid out in detail, line by line and cost by cost (including labor) if it isn't, it's padded for sure.

Consistently late rental disbursements. Vendors that aren't paid or are paid after a 90 day time-frame. Stall tactics when paying bills. No replies to accounting questions when you call or email. Employees that dodge accounting questions. Phony vendor invoices for work that wasn't really done. Asking to speak with the contractor that did the work only to hear, we cant do that, that's confidential information. Getting bulk invoice costs. All estimate items need to be laid out in detail, line by line and cost by cost (including labor) if it isn't, it's padded for sure.In general, there are two ways to improve checks and balances: (1) Separate duties so no one controls a transaction from beginning to end, and (2) Monitor. The latter is the only option in small accounting departments. Having an outside accountant perform periodic unannounced reviews of rent collections, payroll, cash, expense reimbursements and other high risk areas deters Brokers or employees from stealing by increasing the probability of being caught. It can also be effective at identifying problems early – before losses reach six figures.

Minimize risks:

Minimize risks: You as a landlord can request that you hold the tenant security deposit in a separate bank account yourself. And whether you're searching for a property manager or currently with one, always ask to speak with their certified public accountant directly. Ask them if this company is financially sound. The CPA must respond with a yes or no. And do this on an annual basis.

- Financial freedom is available to those who learn about it and work for it.

homeqwestrealty@gmail.com | O.

239.770.5429 | www.homeqwest.com

Tuesday, January 20, 2015

Property Management Calculator

How do we determine what you pay per month?

HomeQwest Realty Group structures fees charged to property Owners once we have had an opportunity to analyze and evaluate your information.

Very seldom are any 2 properties the same other than floor-plan or maybe street appeal, more importantly no 2 Investors are in the same financial position.

How does that effect the rate charged me?

For some of our Investors we charge a flat rate up to $4.00 per day that includes all of our services.

While for others we start at $2.00 per day then add on the services they choose.

Typically commissions are paid at time of leasing but for some we spread that over the term of the lease which would increase the $2.00 per day rate. Some Investors have their own maintenance contractors and handle those emergencies themselves.

Do you have any references that I could check with?

Here is another good question that doesn't really apply to

property management.

Your question should be:

Company

references are mostly doctored or cherry picked for obvious reasons. When was

the last time you asked for a company reference and received a $#!t review? Umm, Never!

I know I wouldn't have my maintenance technician handle my bookkeeping or my bookkeeper handling my leasing.

www.homeqwest.com |

homeqwestrealty@gmail.com | O. 239.770.5429

How Much Are You Currently Paying For Your Property Manager Per Day?

How do we determine what you pay per month?

HomeQwest Realty Group structures fees charged to property Owners once we have had an opportunity to analyze and evaluate your information.

HomeQwest Realty Group structures fees charged to property Owners once we have had an opportunity to analyze and evaluate your information.

Very seldom are any 2 properties the same other than floorplan or maybe street appeal, more importantly no 2 Investors are in the same financial position.

How does that effect the rate charged me?

For some of our Investors we charge a flat rate up to $4.00 per day that includes all of our services.

While for others we start at $2.00 per day then add on the services they choose.

Typically commissions are paid at time of leasing but for some we spread that over the term of the lease which would increase

the $2.00 per day rate. Some Investors have their own maintenance contractors and handle those emergencies themselves.

But hey, if you’re happy with overpaying for

management services then by all means continue to overpay.

Below is an example of typical charges from other management companies:

Follow this link to figure out what you're paying

property manager calculator

Comparing our costs against competitors

As you can see, our fee structure is changing the property management landscape. If your current numbers are different than this example, please feel free to add up all your annual fees to determine how much you are currently paying. We've built a foundation on being compensated for performance. There are no "Up-Front" fees, nor do you have to wait 3 months before you see a profit from your investment.

HomeQwest has removed all up-front costs other property managers charge before a tenant even settles in.

HomeQwest has eliminated the dreaded "Termination Of Contract" fee. If you're not happy with the way we're managing your home, that means you've lost faith in our abilities and if you've lost faith, then you can walk away at anytime without being penalized.

HomeQwest does not have a maintenance crew on staff for this removes the "conflict of interest" issue. We use 3rd party licensed, insured and qualified contractors. You can interact with these contractors as you see fit, pay them directly,negotiate prices or even schedule their services.

Please note: If you feel that the contracted relationship between your current property manager and yourself have become suspect and you lack the feeling of confidence in the fiduciary responsibilities owed to you contractually, please contact your attorney and have them send a letter on your behalf. You wish your contract be returned (terminated) to you along with an accounting of balance belonging to you plus any amount held in escrow for your tenant without any termination fees.

If you feel there have been any improprieties, you need to contact the Florida Department of State, Department of Business and Professional Regulation (DBPR)

This is a very important number you need figure out when

searching for a property manager. Most Landlords focus on the monthly

percentage rate, but when you read your contract you’ll find a lot more fees

that apply scattered throughout the contact.

These fees add up which increase

that monthly percentage substantially. Not to mention the additional 30% - 40%

mark-up on maintenance work that’s done in most cases. If your property manager refuses to give you a bill directly from the licensed vendor doing the work, guess what? MARK-UP!

HomeQwest Realty Group structures fees charged to property Owners once we have had an opportunity to analyze and evaluate your information.

HomeQwest Realty Group structures fees charged to property Owners once we have had an opportunity to analyze and evaluate your information.Very seldom are any 2 properties the same other than floorplan or maybe street appeal, more importantly no 2 Investors are in the same financial position.

How does that effect the rate charged me?

For some of our Investors we charge a flat rate up to $4.00 per day that includes all of our services.

While for others we start at $2.00 per day then add on the services they choose.

Typically commissions are paid at time of leasing but for some we spread that over the term of the lease which would increase

the $2.00 per day rate. Some Investors have their own maintenance contractors and handle those emergencies themselves.

We dare another property management firm match our offer! If

you find one, let us know.

Below is an example of typical charges from other management companies:

Follow this link to figure out what you're paying

property manager calculator

Comparing our costs against competitors

As you can see, our fee structure is changing the property management landscape. If your current numbers are different than this example, please feel free to add up all your annual fees to determine how much you are currently paying. We've built a foundation on being compensated for performance. There are no "Up-Front" fees, nor do you have to wait 3 months before you see a profit from your investment.

HomeQwest has removed all up-front costs other property managers charge before a tenant even settles in.

HomeQwest has eliminated the dreaded "Termination Of Contract" fee. If you're not happy with the way we're managing your home, that means you've lost faith in our abilities and if you've lost faith, then you can walk away at anytime without being penalized.

HomeQwest does not have a maintenance crew on staff for this removes the "conflict of interest" issue. We use 3rd party licensed, insured and qualified contractors. You can interact with these contractors as you see fit, pay them directly,negotiate prices or even schedule their services.

Please note: If you feel that the contracted relationship between your current property manager and yourself have become suspect and you lack the feeling of confidence in the fiduciary responsibilities owed to you contractually, please contact your attorney and have them send a letter on your behalf. You wish your contract be returned (terminated) to you along with an accounting of balance belonging to you plus any amount held in escrow for your tenant without any termination fees.

If you feel there have been any improprieties, you need to contact the Florida Department of State, Department of Business and Professional Regulation (DBPR)

Subscribe to:

Comments (Atom)